franchise tax board phone number for llc

Franchise Tax Board Business Entity Correspondence PO Box 942857 Sacramento CA 94257-4040. 3-0925 or 512 463-0925.

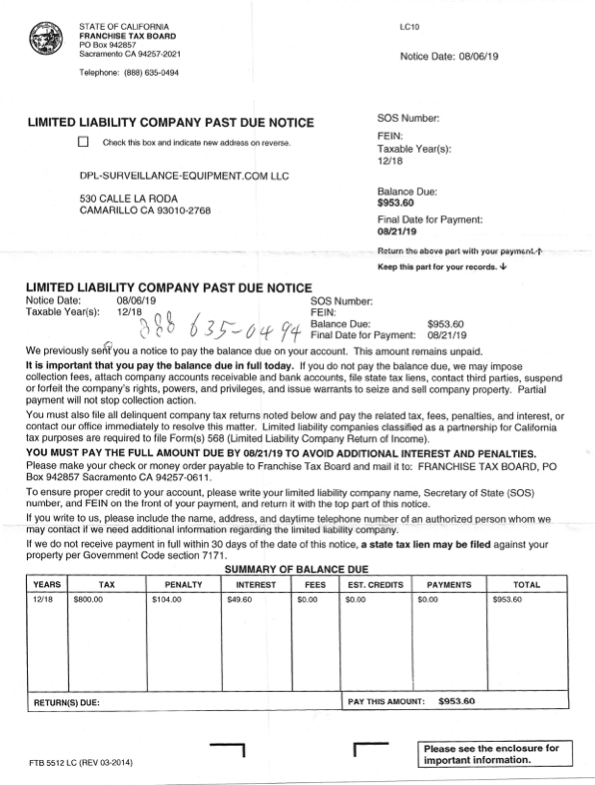

Even The State Franchise Tax Board Is Trying To Scam Me Dpl

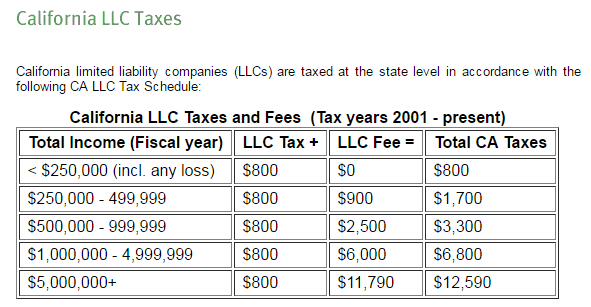

A proposed settlement has been reached in a class action lawsuit against the California Franchise Tax Board FTB challenging the constitutionality of the LLC Fee imposed on limited liability companies LLCs for tax years 1994 through 2006 Proposed Settlement.

. Changes to Franchise Tax Nexus. Use FTB 3522 when paying by mail. The LLC Fee or Levy means the tax that LLCs were.

California Department of Tax and Fee Administration. 26-54-101 et al also known as the Arkansas Corporate Franchise Tax Act of 1979 requires all Corporations LLCs Banks and Insurance Companies registered in Arkansas to pay an annual franchise tax. In that way because the LLC will go into existence in 2021 it doesnt pay an 800 franchise tax payment in 2021.

Visit the IRS website or contact a local office in California. Franchise Tax Board PO Box 942857 Sacramento CA 94257-0631. Customer service phone numbers.

Select Limited Liability Companies. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the. The California Franchise Tax Board administers personal and corporate income and franchise taxes for the State of California.

All LLCs in California must file Form 3522 and pay the 800 Annual. Franchise Tax Board Exempt Organizations Unit MS F120 PO Box 1286 Rancho Cordova CA 95741-1286. While we are available Monday through Friday 8 am-5 pm.

Form 3522 is used to pay the 800 Annual Franchise Tax each year. Weekdays 7 AM to 5 PM. Its about using a Future File Date of 112021 on the California LLC Articles of Organization.

Failure to pay can result in the imposition of additional fees penalties and interest or even revocation of the authorization. California Department of Tax and Fee Administration CDTFA administers more than 30 tax and fee programs that generate revenue essential to our state including sales. For additional information see our Call Tips and Peak Schedule webpage.

The Comptrollers office has amended Rule. The excise tax is based on net earnings or income for the tax year. Visit the FTB Forms page.

Limited liability company LLC forms an LLC to run a business or to hold assets to protect its members against personal liabilities. California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. Customer service phone numbers.

Type of Contact For Limited Liability Companies and Stock Corporations For Nonprofit Corporations. Please answer two security questions. Federal Income and Payroll Tax.

Total Sales of Last Return Filed if new entity enter zero Total Amount Paid of Last Return Filed if new entity enter zero Total Revenue from Previous Year if new entity enter zero RT XT. Employment Development Department 3321 Power Inn Road Second Floor Sacramento CA 95826. Look for Form 3522 and click the download link.

Select the appropriate tax year. Please have your 11-digit taxpayer number ready when you call. 800-822-6268 Phone Hours of Availability.

Central Time shorter wait times normally occur from 8-10 am. Franchise Tax Board FTB Our mission is to help taxpayers file tax returns timely accurately and pay the correct amount to fund services important to Californians. Its first 800 franchise payment will by due by April 15th 2022.

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. And Franchise Tax Board.

Franchise Tax Board We Can Help Consulta Gratis 888 468 0609 Servicio Al Cliente 888 959 0207

Franchise Tax Board Payments Arrcpa

Franchise Tax Board Ca Ftbfiling Sc Twitter

How To Speak With An Actual Representative At The Franchise Tax Board Of California Ca Ftb Quora

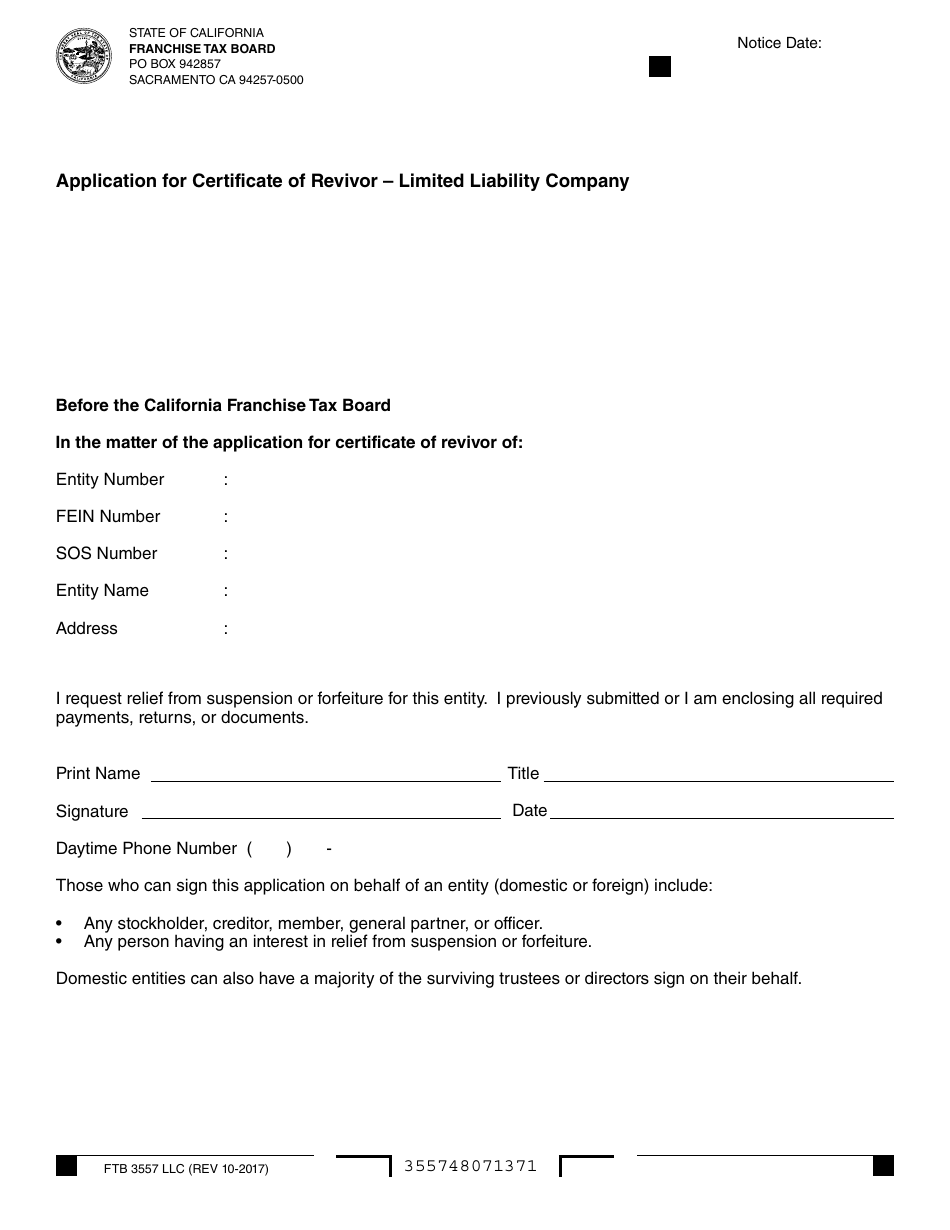

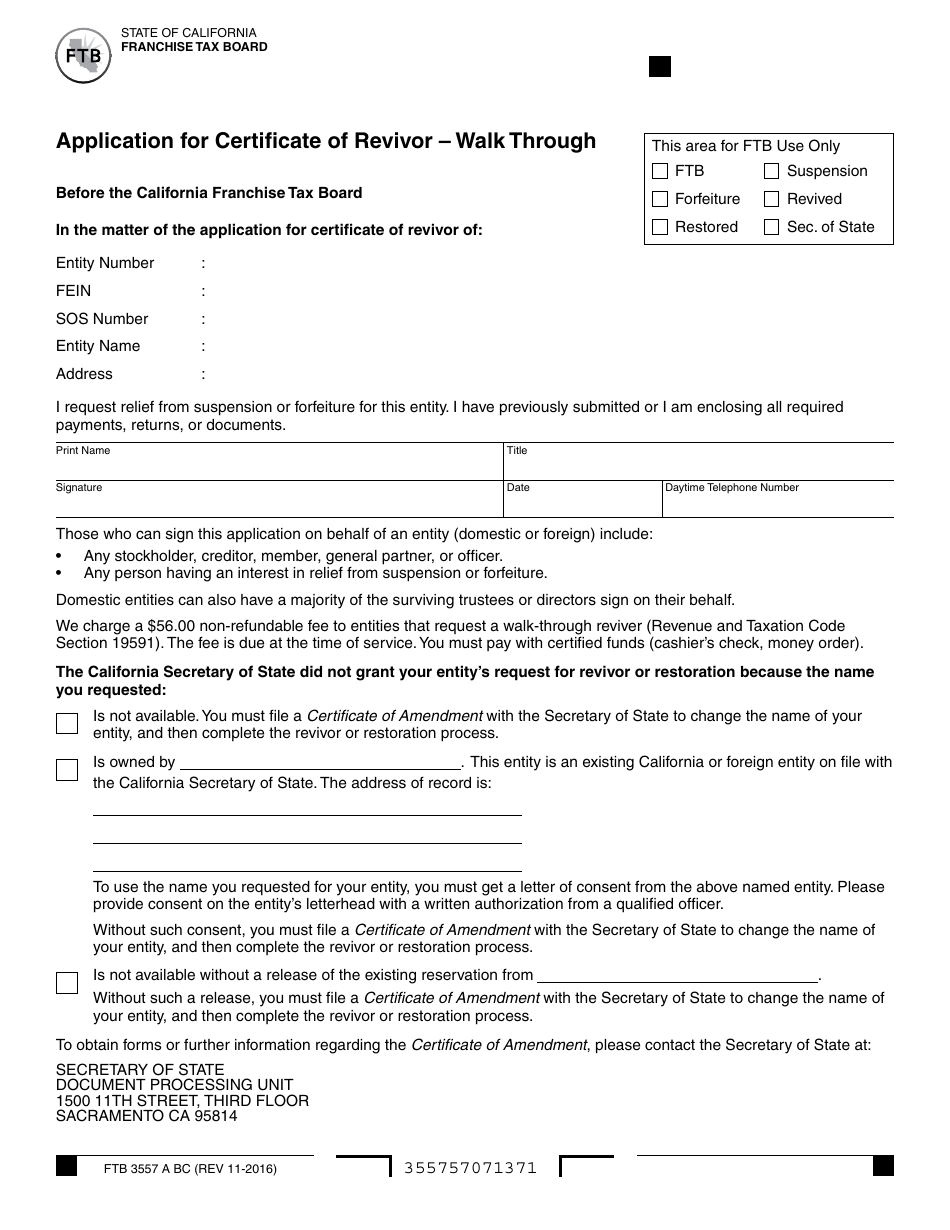

Form Ftb3557 Llc Download Fillable Pdf Or Fill Online Application For Certificate Of Revivor Limited Liability Company California Templateroller

How To Pay Your California Llc 800 Annual Franchise Tax Online Without Franchise Tax Board Account Youtube

Franchise Tax Board Payments Arrcpa

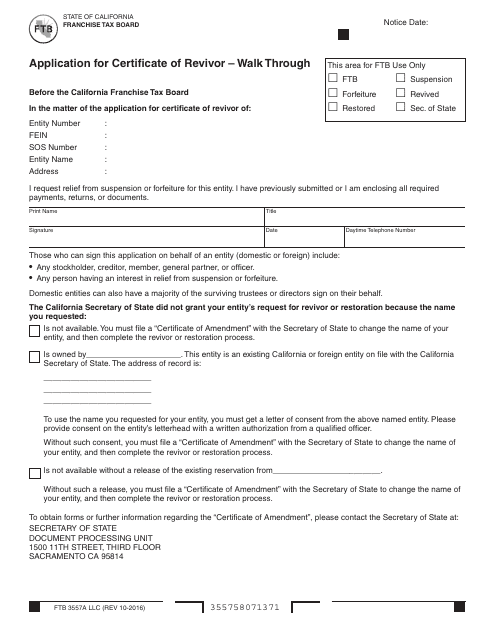

Form Ftb3557a Llc Download Fillable Pdf Or Fill Online Application For Certificate Of Revivor Walk Through California Templateroller

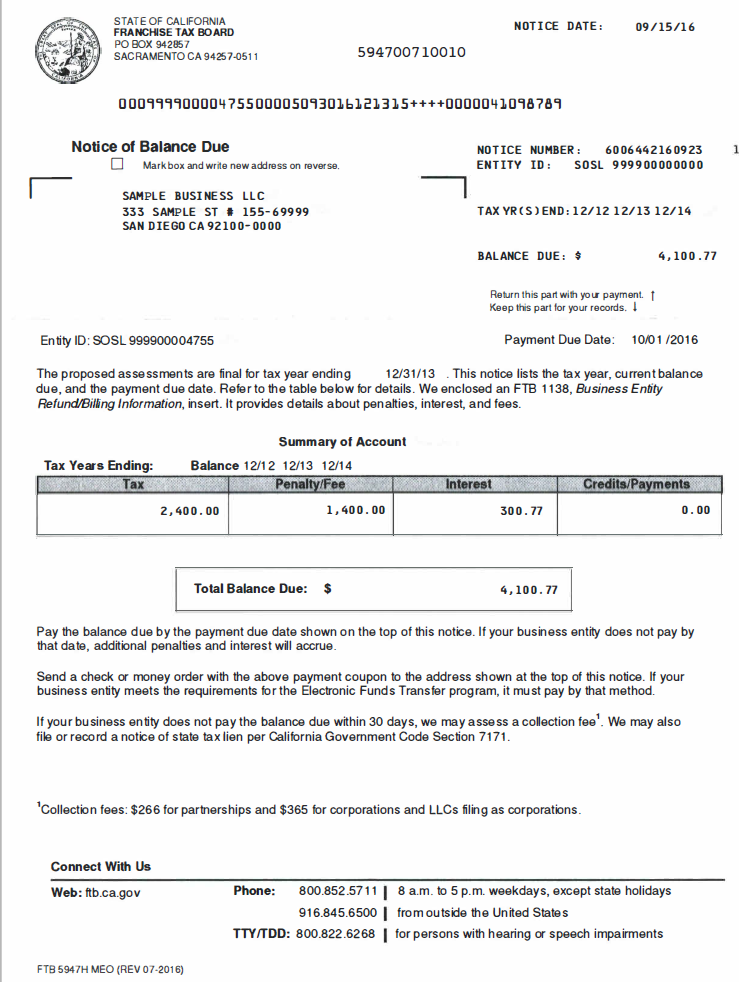

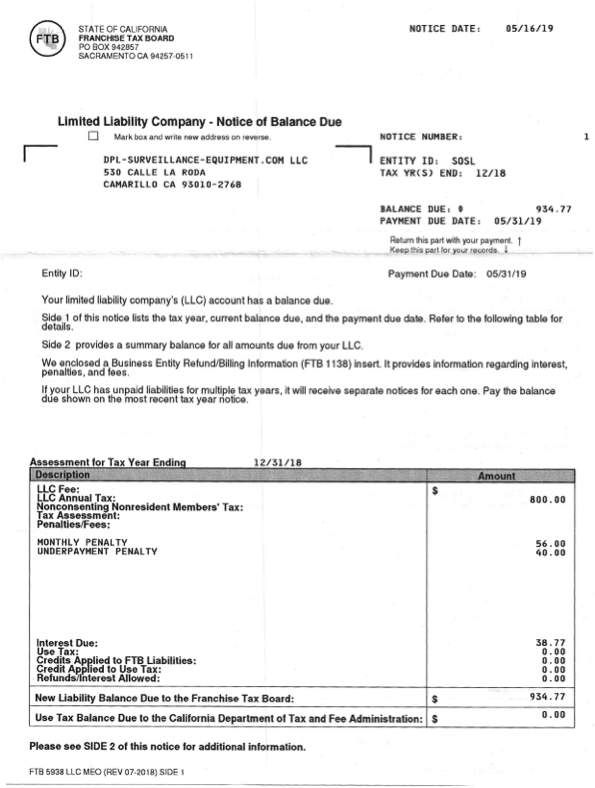

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

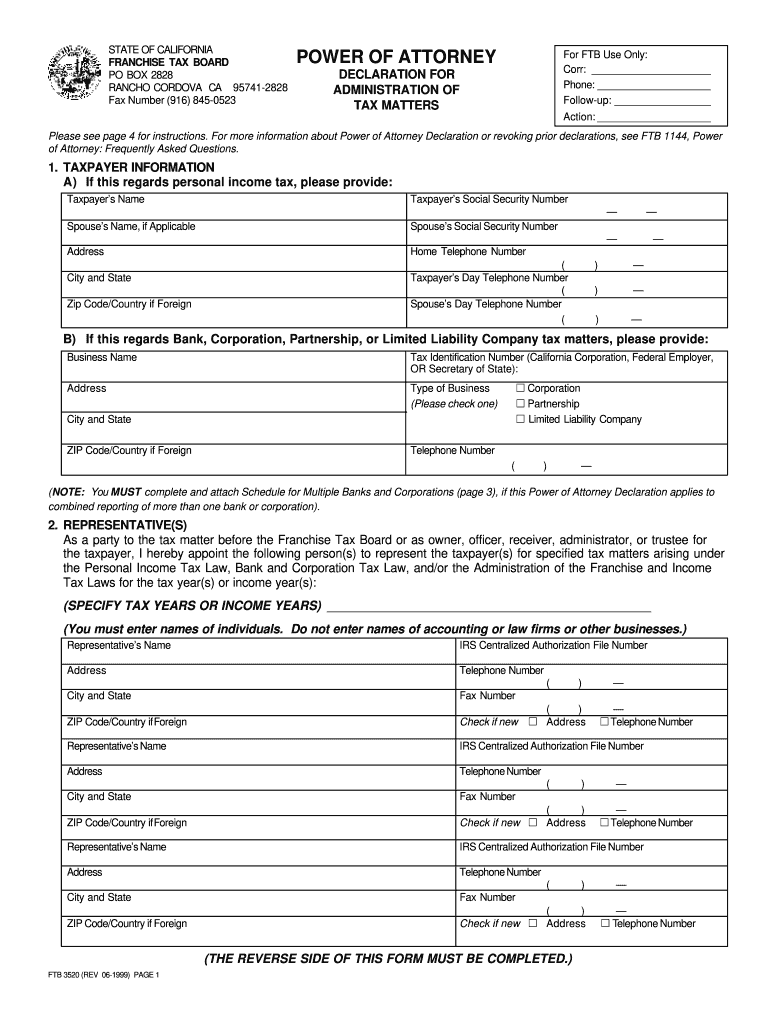

Franchise Tax Board Fill Online Printable Fillable Blank Pdffiller

Form Ftb3557 A Bc Download Fillable Pdf Or Fill Online Application For Certificate Of Revivor Walk Through California Templateroller

Even The State Franchise Tax Board Is Trying To Scam Me Dpl

Franchise Tax Board Notice Of Balance Due Llcs Nyc Tax Accounting Services George Dimov Cpa